The 2025 LinkedIn Ads Benchmarks Report has dropped - here are the highlights

Our 2025 LinkedIn Ads Benchmarks Report is live!

Based on aggregated data of thousands of deals from hundreds of Dreamdata B2B customers, our LinkedIn Ads benchmarks report uncovers the biggest trends shaping B2B advertising on LinkedIn - from budget allocation shifts to ROAS benchmarks and the evolving role of LinkedIn in the customer journey.

If you’re investing in LinkedIn Ads, this report will give you insights into what’s working, what’s not, and how B2B marketers across the globe are optimizing their campaigns for maximum impact.

In this blog, we’re summarizing the report’s key takeaways, but for the full in-depth analysis, including detailed insights, analysis, and LinkedIn Ads’ expert advice, download the complete report now ⤵️

1. LinkedIn Ads’ share of the budget grows to 39%

In 2024, LinkedIn Ads’ share of total B2B ad budgets grew from 31% in H1 to 39% by year-end.

According to our data, this means LinkedIn now represents the largest single-channel spend when breaking down Google’s Network into its component platforms: Search, Display, and YouTube. Google Search Ads non-branded spend comes in at second place, taking 37% of the average budget.

💡 Point of View: This shift likely reflects marketers’ growing confidence in LinkedIn’s precise B2B targeting capabilities, which allows them to reach decision-makers directly in ways no other platforms can.

2. LinkedIn ads drive the best ROAS

When looking at our aggregated customer data on ad cost and return, we found that while LinkedIn Ads runs higher costs per click and impression it delivers the lowest cost at the company level - with the cost per company influenced being 25% higher on Google Search Ads and 70% higher on Meta.

When looking at the data on return, we see LinkedIn Ads generating the highest ROAS (113%) of all major networks, outperforming Google Search (78%) and Meta Ads (29%).

💡 Point of View: While LinkedIn ads may appear expensive at first glance, their ability to generate a positive return on investment makes them a strong investment.

3. The B2B Customer Journey 211 days long

Our data proves just how long the B2B buying journey really is, with the average customer journey lasting 211 days. This is even longer for larger companies, whose customers take 49% longer on average to buy.

The biggest bottleneck is the MQL to SQL stage, where leads take over three months to move forward.

We also took a look at the influence of the major ad platforms on the customer journey. That is, of all the thousands of customer journeys across hundreds of our customers, how many leads, opportunities, and new business deals had at least one touch on an ad platform.

LinkedIn came up top once again here, influencing 29% of MQLs, 36% of SQLs, and 35% of New Biz deals - more than Google or Meta. Check out the report for the full comparison →

💡 Point of View: Marketers can’t ignore the role of nurturing leads towards the pipeline - the longest part of the customer journey. Doing so can help shorten the time to revenue. LinkedIn Ads, with its precise targeting, can be instrumental in these ABM plays.

4. LinkedIn Ads time to revenue

We also looked at the data on different types of LinkedIn Ads engagement. Here, we found that the average time from the first LinkedIn Ads impression to revenue is 320 days, from ad engagement (like, comment, click) to revenue is 235 days, and from first conversion to revenue is 219 days.

💡 Point of View: Though LinkedIn Ads have a longer journey to conversion (320 days vs. 211 days on average), this aligns with B2B buying behavior - most buyers aren’t in-market, as per the 95:5 rule. LinkedIn delivers consistent impressions to keep brands top of mind until prospects are ready to buy.

5. LinkedIn CAPI: A Game-Changer for Performance Optimization

LinkedIn found that CAPI users see a 20% lower CPA and a 31% increase in attributed conversions, compared to non-integrated users.

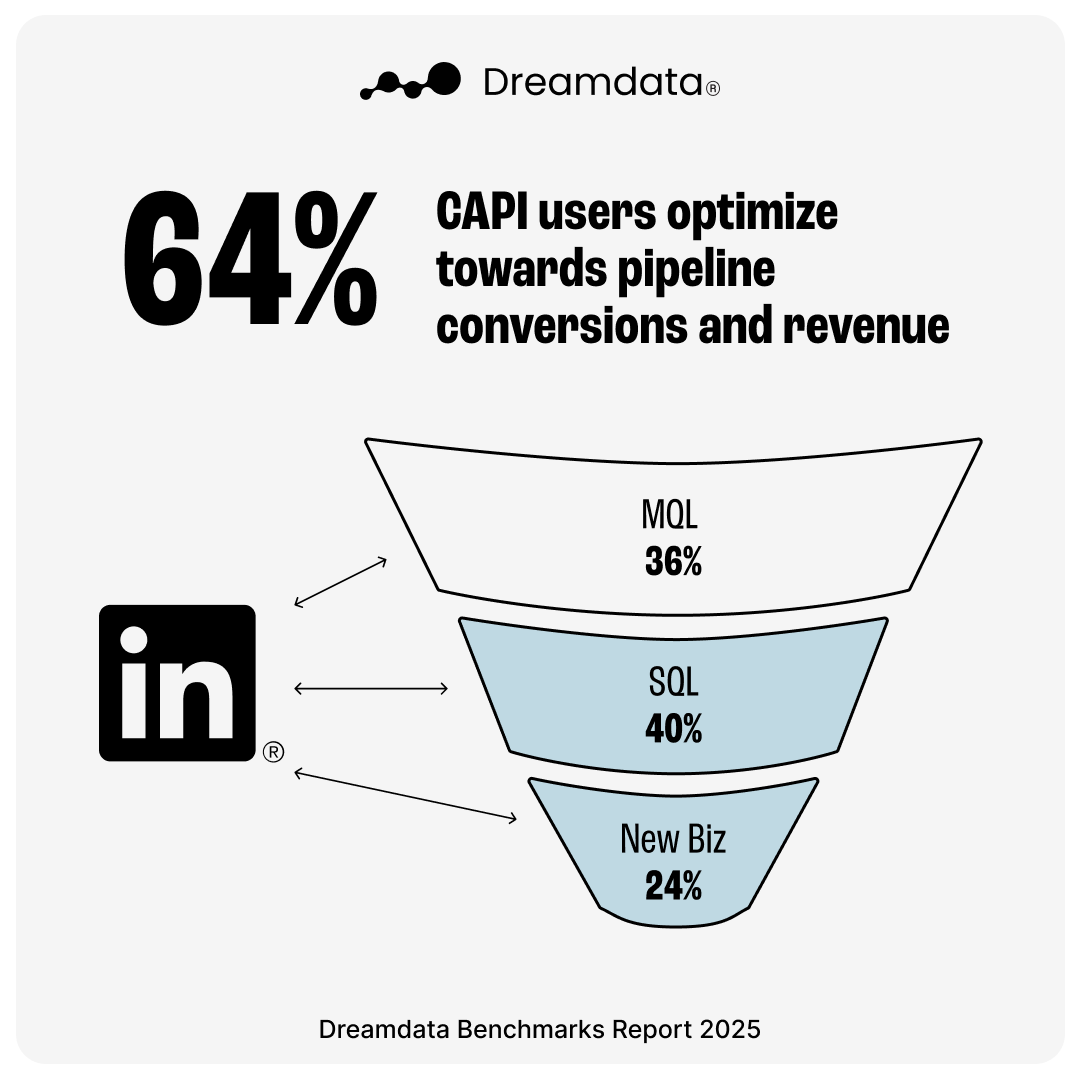

75% of Dreamdata customers using LinkedIn Ads have integrated LinkedIn’s Conversions API (CAPI). And our data finds that the majority of these users advertisers feed revenue and pipeline data back to LinkedIn, as opposed to first-conversion level data, allowing for automated optimization based on real business outcomes.

💡 Point of View: Sending pipeline and revenue data to LinkedIn via CAPI ensures campaigns are optimized for actual business impact, not just clicks.

Download the full report

Our data is clear: LinkedIn ads are playing an increasingly important role in B2B marketing. While the platform’s costs may seem high, its ability to drive strong ROAS and influence key stages of the buying journey proves just how powerful the channel’s targeting is for reaching decision-makers.

Get the full data breakdown and expert advice by downloading the full 2025 LinkedIn Ads Benchmarks Report now →